The concept of electric motorcycles and vans as institutional assets is no longer theoretical; it’s at the fore of the now and the future. For decades, #commercialvehicles were viewed as depreciating tools of trade, not assets you’d expect to see in a pension fund’s portfolio. But today, with the explosive growth of last-mile delivery and electrification mandates, fleets of delivery vehicles are emerging as a viable, scalable investment opportunity.

What’s genuinely striking is just how under-institutionalised this asset class remains. Vehicles represent the fourth-largest physical asset class globally, valued at approximately $15 trillion, yet only 3 to 5% is institutionally held. Compare that to aircraft at around 60%, data centres at 40 to 50%, real estate at 35 to 40%, and even farmland at 25 to 30%. The opportunity before us is enormous.

As our team have been building #ONEMOTO, we’ve witnessed this transformation first-hand. Over the past year, we’ve been developing opportunities across Eastern Europe, the GCC and Latin America, meeting with institutional investors, syndication partners, fleet operators and delivery platforms. We’ve secured a $20m term-sheet, genuine interest and demonstrated real market need. We’re now finalising our first fleet-backed transactions across the GCC and Eastern Europe, aiming to convert over 10,000 electric #delivery vehicles into yield-producing real-world assets (RWA), with Web3 playing a significant role in our transition.

We discuss the macro shifts behind this opportunity and how data and AI are enabling a fresh approach to vehicle investing, grounded in the execution of our own strategy at ONE MOTO.

Why Now: The Last-Mile Delivery Revolution

Several converging trends have set the stage for delivery vehicles to become an institutional investment. The e-commerce boom continues unabated, and consumers increasingly expect same-day or next-day delivery as standard. The last-mile delivery market is experiencing unprecedented growth, driven by changing shopping habits and the permanent shift towards online retail that accelerated during the pandemic.

This doesn’t mean fewer delivery vehicles on the road; quite the opposite. It means dramatically higher demand for purpose-built delivery fleets, whether that’s electric motorcycles for urban parcel and food delivery or light commercial vans for larger loads. For those who supply and manage these fleets, this translates into robust, predictable demand for vehicles as a service, paid for by #logistics companies, #ecommerce platforms and delivery startups on a usage basis.

Institutional capital is already familiar with vehicle assets in other sectors. The European leasing and rental industry financed approximately €448 billion in new assets in 2023, an increase of 10.8% over the prior year. Notably, about 74% of that (over €330 billion) went into automotive assets, including commercial vehicles. Banks, leasing companies and funds are already acquiring vehicles in volume and leasing them out, effectively treating them as yield-generating assets. This institutional activity demonstrates the concept: vehicles can be yield-generating, portfolio-managed assets.

How does this impact the last-mile delivery vehicle sector specifically? Here’s the reality: globally, there are over 300 million delivery vehicles made up of motorcycles and light commercial vehicles. This is our market. This is our focus at ONE MOTO.

Meanwhile, macro-economic conditions have created a new urgency. High interest rates and inflation have made traditional vehicle financing more expensive, squeezing operators who need to refresh or expand their delivery fleets. Many mid-tier logistics companies and delivery startups simply can’t shoulder the debt load of purchasing more vehicles at today’s rates, nor can smaller operators easily access bank financing. In response, we’re seeing growing demand for leasing solutions that can scale, creating a clear opening for purpose-built vehicle #investmentfunds to step in with structured fleet financing.

The push for #electrification in #urbandelivery is backed by both government mandates and consumer pressure, adding tremendous momentum. Cities across Europe and beyond are implementing zero-emission zones, effectively requiring electric delivery vehicles for last-mile operations. However, this transition brings challenges that sophisticated investors are uniquely equipped to manage. Electric vehicles have introduced significant residual value uncertainty. The sharp decline in used EV prices over the past two years has challenged traditional leasing firms, forcing them to adapt by extending lease terms, exploring new resale channels and negotiating buyback arrangements to mitigate losses. Rather than undermining the asset class, this volatility underscores the importance of a more agile, data-driven approach to fleet management under an institutional strategy. This is precisely what ONE MOTO is building.

AI Turns Delivery Vehicles into Data-Driven Assets

If the macro trends provide the “why” for this asset class, technology provides the “how.” Managing thousands of delivery vehicles for profit is inherently complex, but today’s data analytics, connectivity and AI tools make it not only feasible but genuinely attractive. Real-time data and AI allow us to manage fleet assets with a level of precision and foresight that was unimaginable even a few years ago.

Consider the impact on a fleet’s biggest cost: depreciation. Depreciation can represent 40 to 50% of a delivery vehicle’s total cost of ownership, but it’s now a manageable risk. With IoT telematics and AI, we can preserve residual values by actively managing each vehicle’s life cycle. At ONE MOTO, we use data platforms to track maintenance schedules and predict repairs across our delivery motorcycles and vans, scheduling service before breakdowns occur. This reduces wear and tear and avoids the sudden loss of value that comes from major mechanical failures. It also dramatically slashes costly downtime, which is critical when vehicles need to be on the road generating revenue.

Telematics allow us to ensure vehicles are used in ways that protect their value. We monitor mileage, charging patterns and usage intensity, receiving alerts for any excessive wear or potential issues. If an electric motorcycle in the portfolio is being operated outside optimal parameters (perhaps inadequate charging habits or overly aggressive riding), we know about it immediately and can intervene. These data-driven controls translate into tangible financial outcomes: better-maintained vehicles fetch higher resale prices and suffer fewer unexpected losses.

AI and analytics are also reshaping how we underwrite and allocate capital for vehicle investments. Instead of relying solely on historical averages, we can model fleet performance with granular data. We can underwrite deals by analysing delivery route data, package volume forecasts in a city, and operator reliability metrics. We can price risk on a per-mile or per-delivery basis and structure financing with dynamic terms. For example, revenue-sharing leases or usage-based financing can align the interests of fleet operators and investors in real time.

To illustrate, think of how airlines and aircraft lessors manage jets: every plane’s hours, cycles, maintenance status and market value are meticulously tracked to optimise its lease and resale. We’re now applying a similar playbook to delivery vehicle portfolios at ONE MOTO, using connectivity and AI to treat each motorcycle and van not just as a vehicle, but as a data-emitting, revenue-generating asset with an optimised life cycle plan.

Not just a Thesis: Building ONE MOTO

When we set out to unite Web3 with the mobility sector, bridging the tangible and intangible aspects of crypto through DePIN and DeFi, it was genuinely challenging. Traditional VCs don’t fully grasp our asset class or the investment opportunity. However, across Europe and the USA, there’s a different story; institutional investors are hungry for diversified investments and new asset classes. We were driven by a conviction that this trend could be executed in practice, aligned with the next generation of crypto savvy investors who want and need to see a tangible asset backing their investment.

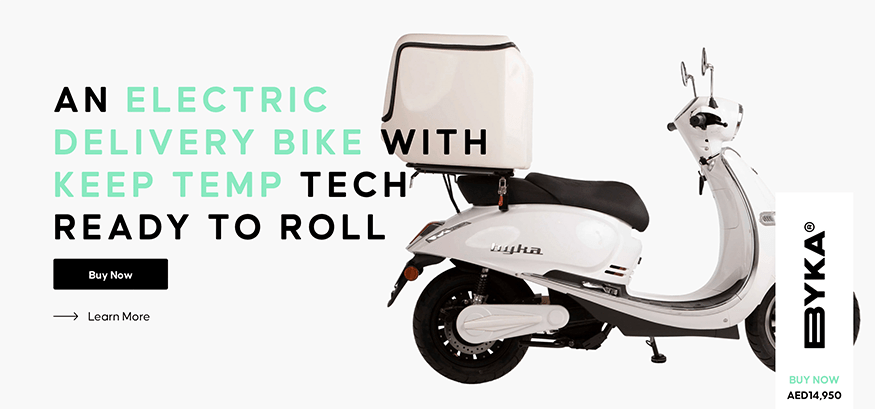

ONE MOTO’s thesis is straightforward: we produce electric delivery motorcycles and vans and lease them to established operators across Europe, the Middle East and Africa, using data to select high-performing vehicle models, refine resale timing and monitor real-time usage to protect value and boost yield. As we are building them, we are able to reduce the layers of margin from the ‘traditional’ multi-layered stakeholder margins. Providing a more profitable and sustainable vehicle network.

We’re already engaging with fleet operators and capital partners in key markets. For example, we’ve partnered with established delivery platform operators and logistics companies who need hundreds or thousands of new electric vehicles but lack affordable financing. Our model is designed to acquire vehicles using investor capital and lease them to operators on structured terms. This provides an alternative to high-cost debt and supports scalable fleet expansion whilst accelerating the transition to zero-emission delivery.

What’s Ahead for us all?!

From our vantage point, the institutionalisation of delivery vehicles is just beginning. The demand for reliable, electric last-mile delivery solutions is surging. Government mandates are accelerating fleet electrification across urban centres. Digital platforms are scaling delivery services faster than traditional manufacturers or banks can keep pace. Meanwhile, investors are seeking hard assets with real yield and downside protection.

Electric delivery vehicles as an institutional asset class are here to stay. These aren’t just depreciating machines anymore; they’re connected, productive assets with predictable cash flows. And for investors ready to engage with data and execution, they represent a genuine frontier.

Our goal at ONE MOTO is clear: make electric delivery vehicles the next great yield-producing asset class, one that’s predictable, data-backed and institutionally investable.