As we continue to expand our international footprint, there is always a very firm focus to continue to build upon our beachhead market. We were the first to the region, the change makers, the dreamers. Driven by customers, companies, the government, all had needs – we continue to deliver upon the wants for the future too.

This article presents the latest financials and forecasts for the country. We believe these figures understate the potential growth based on our primary research. Share your thoughts with us!

If you are wanting to discuss new markets with us, reach out and we’ll make it happen.

In recent years, the United Arab Emirates (UAE) has witnessed a seismic shift in consumer behaviour, driven by technological advancements and changing lifestyles and there’s no denying COVID-19 played a leading role!

This transformation has propelled the food and e-commerce delivery sector into the spotlight, with an unprecedented surge in demand for convenient and efficient delivery services. As the industry continues to evolve, navigating the intricacies of delivery volumes, costs, and forecasted growth becomes essential for businesses operating in this dynamic landscape.

Explosive Growth in Delivery Volumes

The UAE’s food and e-commerce delivery sector has experienced exponential growth, fuelled by a burgeoning population thanks to the vision and invitational platform for the world to explore, increasing urbanisation across the Emirates, and a relentless appetite for convenience. Recent statistics project that the UAE’s food last-mile delivery market will reach a value of USD 2.2 billion by 2025, growing at a compound annual rate of 14.2% from 2020 to 2025.

Similarly, the e-commerce sector has witnessed a remarkable uptick in delivery volumes, with online retail sales in the UAE expected to surpass USD 31 billion by Q4 this year largely due to the prominent marketplaces like Temu and Shein. The COVID-19 pandemic has further accelerated this surge in demand, prompting consumers to embrace online shopping and home delivery services at an unprecedented pace.

Cost Impact and Operational Cause

While the growth prospects for the food and e-commerce delivery sector in the UAE are promising, businesses face a myriad of challenges, particularly concerning delivery costs and operational efficiency. Fluctuating fuel prices, labour expenses, and infrastructure investments exert pressure on delivery service providers and fleet operators to streamline operations and optimise costs without compromising service quality. The multiple stakeholders are affected at varying degrees with a responsibility to their riders being a factor (profit vs welfare).

Recent studies indicate that the average (all-inclusive/aggregated stakeholder) cost per delivery in the UAE ranges from AED 20 to AED 50, depending on various factors such as distance, delivery speed, CaC, servicing and maintenance and order volume (with customers seeing a AED 7-AED 20 price, plus ‘service fee’). However, achieving profitability remains a significant challenge for many delivery businesses, especially in light of fierce competition and evolving consumer expectations.

Forecasted Growth and Market Opportunities

Despite the challenges, the future outlook for the food and e-commerce delivery sector in the UAE remains optimistic, driven by technological innovation, demographic trends, and shifting consumer preferences. Industry analysts expect sustained growth in delivery volumes, driven by leading operators setting market milestones, adopting digital payments, and proliferating delivery platforms.

Furthermore, the emergence (approximately five years ago) of new delivery models, such as dark kitchens cloud kitchens, and autonomous delivery vehicles, presents exciting opportunities for businesses to enhance efficiency, reduce costs, and cater to evolving consumer demands. With the UAE government’s continued focus on digital transformation and infrastructure development, the stage is set for continued expansion and innovation in the delivery sector.

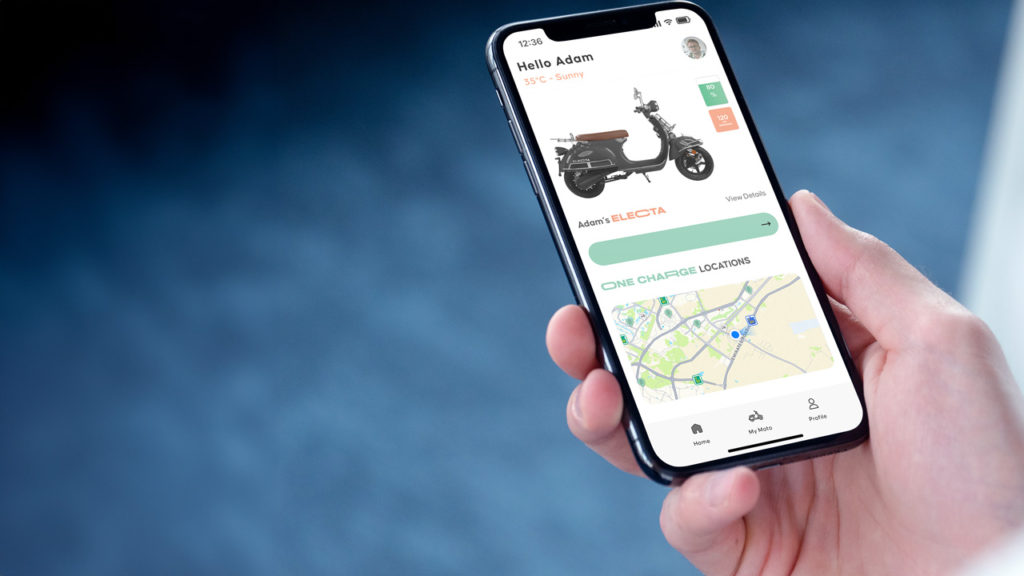

As ONE MOTO – Electric Vehicles pioneered two-wheeled electric vehicles in the GCC, generating a market leader presence was tough, a tremendous amount of knowledge sharing (by all stakeholders) in the value chain. As more of our electric delivery vans begin to roll out across the UAE we’ll once again demonstrate the positives of a sustainable delivery network – we’re looking forward to our partners making these announcements very soon.

To discuss our distribution model and to be a part of our next country launch get in touch